🔒100% Secure 256-Bit Security Encryption

What You'll Learn in This Step-by-Step GUIDE

Craft Your Personal Gold Blueprint for Lasting Wealth

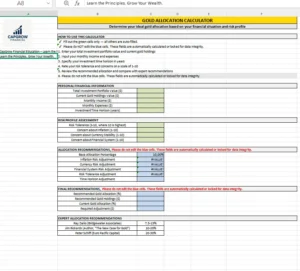

Unlock Automated Tools for Effortless Investment Planning

Implement a Proven Monthly Action Plan for Disciplined Results

Master Your Gold Portfolio with Advanced Tracking & Optimization

What Others Are Saying

“What I loved the most were the tools in the appendix! The Allocation Calculator and the Investment Tracker are incredibly useful. The eBook doesn’t just teach theory — it gives you the tools to put it into practice.”

– Ashley T., 40 Denver, Colorado

“What impressed me the most was how clearly the eBook explains how to build a gold investment strategy , and especially how to plan monthly contributions. It turned something that seemed complex into simple, achievable steps. I’ve already started investing!”

– Joshua S., 41, Columbus, Ohio

“With rising inflation and constant global trade tensions, I was looking for a reliable way to protect my savings. This eBook helped me understand why gold remains such a powerful hedge in uncertain times. The chapters are easy to follow, and the tools made it simple to put the knowledge into action. I now feel more financially prepared for whatever comes next.”

– Matthew T., 48, Forth Worth, Texas

“I bought this eBook because I wanted a secure way to protect my retirement savings. The step-by-step guide — from how to buy gold safely — to setting up a monthly routine. The appendix tools are easy to use and great for keeping track of everything.”

– Scott M., 67, Seattle, Washington

“At 36, I realized it was time to get serious about planning my financial future — especially with inflation eating away at savings year after year. This eBook gave me the clarity and structure I needed to start investing in gold with confidence. The strategy in Chapter 2 made total sense, and the tools in the appendix helped me take action right away. It’s practical, well-explained, and exactly what I needed at this stage of life.”

— Melissa R., 36 Baltimore

Peek Inside: Here’s Exactly What You’ll Discover...

DON'T MISS OUT!

CHOOSE YOUR GOLD MASTERY PACKAGE:

-

Full 6-Chapter Guide: Step-by-Step Gold Strategy Blueprint

- Create Your Monthly Investment Planning System

- Access 5 Automated Excel Investment Tools& Resources

$127 TODAY: $37

-71%

This Opportunity Ends:

- Full 5-Chapter Guide: Step-by-Step Mindset Lessons

- Develop Your emotional Control to take Racional and Smart Decisions

-

Access and learn how to use our Optimal Checklist: The Mindset Safeguard Before Every Investment Decision.

$97 TODAY: $47

-51%

This Opportunity Ends:

BEST VALUE

- The Complete Guide to Regular Investing: Full Access

- Gold Investor Mindset: Full Access

- The Gold Starter Guide

- All Investment Tools and Automated Sheets

Total Value: $585

$224 TODAY: $77

-65%

This Opportunity Ends:

🔒100% Secure 256-Bit Security Encryption

🛡️Guaranteed Safe Checkout

30-Day 100% Money-Back Guarantee — No Questions Asked

What You'll Learn in This Step-by-Step GUIDE

Master Your Inner Investor for Lasting Gold Wealth

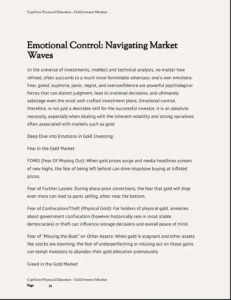

Stop letting fear and greed dictate your decisions! This guide dives deep into the core psychological principles that separate successful long-term gold investors from the rest. Understand your own biases, conquer emotional triggers, and build the unshakeable mental fortitude needed to navigate market volatility with confidence and clarity.

Unlock the Secrets to Disciplined & Rational Gold Investing

Discover the hidden mental frameworks used by elite investors to stay the course, avoid common pitfalls like FOMO and panic selling, and make consistently rational decisions aligned with your long-term goals. Learn to identify and neutralize the psychological traps that sabotage most investors’ returns.

Build Unshakeable Confidence in Your Gold Strategy

Transform doubt into decisiveness! Develop the crucial mindset shifts required to trust your strategy, execute with discipline, and maintain a long-term perspective even when markets are turbulent. Learn practical techniques to manage anxiety, cultivate patience, and reinforce your commitment to your financial future.

Harness Psychological Insights for Smarter Portfolio Decisions

Go beyond the numbers! Understand how behavioral finance impacts your gold investment choices. Learn to recognize cognitive biases in real-time, leverage psychological principles for better risk assessment, and align your mental state with your financial objectives for truly optimized results.

What Others Are Saying

– David L., 52, Austin, Texas

Peek Inside: Here’s Exactly What You’ll Discover...

Chapter 1: Understanding Financial Mindset: The crucial link between your psychology and your portfolio’s success.

Chapter 2: Fundamental Principles of the Successful Investor: Core mental habits and beliefs that drive long-term wealth.

Chapter 3: Gold as an Investment: Understanding its unique role through a psychological lens.

Chapter 4: The Specific Mindset for Investing in Gold: Tailoring your mental approach to the unique challenges and opportunities of the gold market.

Chapter 5: Case Studies and Practical Examples: Real-world scenarios illustrating mindset pitfalls and triumphs in gold investing.

Conclusion: The Continuous Journey of the Gold Mindset: Cultivating lifelong mental resilience for enduring financial well-being.

DON'T MISS OUT!

CHOOSE YOUR GOLD MASTERY PACKAGE:

The Complete Guide to Regular Gold Investing

A Clear Step-by-Step Plan to Grow Wealth with Dollar-Cost Averaging

-

Full 6-Chapter Guide: Step-by-Step Gold Strategy Blueprint

- Create Your Monthly Investment Planning System

- Access 5 Automated Excel Investment Tools& Resources

$127 TODAY: $67

-47%

This Opportunity Ends:

Gold Investor Mindset

Unlock the psychological secrets to successful long-term investing and overcome common pitfalls.

- Full 5-Chapter Guide: Step-by-Step Mindset Lessons

- Develop Your emotional Control to take Racional and Smart Decisions

-

Access and learn how to use our Optimal Checklist: The Mindset Safeguard Before Every Investment Decision.

$97 TODAY: $47

-51%

This Opportunity Ends:

BEST VALUE

Complete Gold Mastery Bundle

Both Premium Guides + Exclusive Bonuses

- The Complete Guide to Regular Investing: Full Access

- Gold Investor Mindset: Full Access

- The Gold Starter Guide

- All Investment Tools and Automated Sheets

Total Value: $585

$224 TODAY: $77

-65%

This Opportunity Ends:

🔒100% Secure 256-Bit Security Encryption

🛡️Guaranteed Safe Checkout

30-Day 100% Money-Back Guarantee — No Questions Asked

Your Future Self Is Watching. Make the Decision You Won't Regret.

Disclaimer

This page and the accompanying eBook are provided for educational and informational purposes only and do not constitute financial, investment, legal, or tax advice. Nothing on this site should be interpreted as a recommendation to buy, sell, or hold any security or commodity. You are solely responsible for your own investment decisions.

No Warranties; No Liability

While we have made every effort to ensure the accuracy of the information contained herein, we make no warranties—express or implied—regarding its completeness, usefulness, or accuracy. We will not be held liable for any errors or omissions, or for any outcomes resulting from your use of this information.

Risk Acknowledgment

All investments involve risk, including the possible loss of principal. Past performance is not indicative of future results. Before making any investment, you should consult with a qualified financial advisor who can evaluate your individual needs, objectives, and risk tolerance.

Affiliate Disclosure

Some of the links on this page are affiliate links. This means we may earn a small commission—at no extra cost to you—if you choose to purchase through those links. We only recommend products and services we genuinely believe in.

Non-Affiliation Notice

This site is not affiliated with, endorsed by, or sponsored by Google, Meta, or any other third-party platforms. All trademarks and logos are the property of their respective owners.

Copyright

© 2025 CapGrow FInancial Education. All rights reserved.