The Billionaire's Hedge: Why America's Smartest Investors Are Quietly Turning to Gold.

For Americans seeking to escape the chaos of the markets and protect their family's future with a solid, time-tested investment.

For Those Who Prefer to Read... Here’s the Full Story Behind the Billionaire's Hedge.

That “I Should Have Invested…” Feeling is All Too Common.

You know the feeling. Seeing an opportunity pass you by, whether it was Bitcoin ten years ago or a simple, smart move you just didn’t make. That feeling of regret is a signal. It’s your mind telling you it’s time for a plan. A real plan to stop missing the moment.

The Problem: Your Wealth is at the Mercy of a Chaotic Market.

Every day, you see it. Stocks swing wildly on a single tweet. Crypto coins vanish overnight. Inflation silently eats away at your hard-earned savings. In this environment, growing and even protecting your wealth feels like a gamble. It’s stressful, it’s confusing, and it leaves your family’s future vulnerable.

But The Answer Has Been Here For Centuries… It’s Time You Used It.

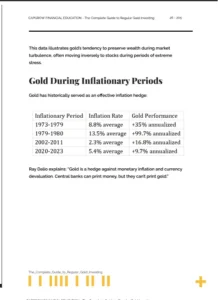

While the world chases trends, smart money has always relied on something solid. Something real. Gold. It’s not a hyped-up tech stock. It’s the bedrock of wealth. It’s what kings and central banks hoard. It’s the ultimate shield against inflation and geopolitical chaos. No matter what happens in the world, gold endures.

But billionaires and central banks don’t just buy gold. They follow a strategy. A discreet, proven method for acquiring and storing it that maximizes its power as a financial shield. The secret isn’t that they own gold. The secret is in how they do it.

Peek Inside: Here’s Exactly What You’ll Discover...

Chapter 3: Planning Your Monthly Gold Contributions

Chapter 4: Where and How to Buy Gold Safely

Chapter 5: Establishing Your Monthly Gold Investment Routine

Chapter 6: Tracking and Adjusting Over Time

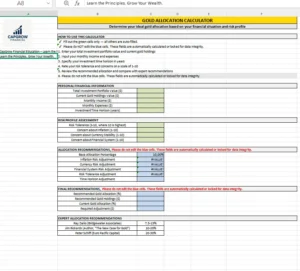

Appendix: Investment Tools and Resources (Gold Allocation Calculator, Monthly Investment Planner, Investment Tracker, Performance Dashboard, Rebalancing Tool)

What You'll Learn in This Step-by-Step GUIDE

Craft Your Personal Gold Blueprint for Lasting Wealth

Unlock Automated Tools for Effortless Investment Planning

Implement a Proven Monthly Action Plan for Disciplined Results

Master Your Gold Portfolio with Advanced Tracking & Optimization

Feedback From Our Complete Guide to Regular Gold Investing Ebook

“What I loved the most were the tools in the appendix! The Allocation Calculator and the Investment Tracker are incredibly useful. The eBook doesn’t just teach theory — it gives you the tools to put it into practice.”

– Ashley T., 40 Denver, Colorado

“What impressed me the most was how clearly the eBook explains how to build a gold investment strategy , and especially how to plan monthly contributions. It turned something that seemed complex into simple, achievable steps. I’ve already started investing!”

– Joshua S., 41, Columbus, Ohio

“With rising inflation and constant global trade tensions, I was looking for a reliable way to protect my savings. This eBook helped me understand why gold remains such a powerful hedge in uncertain times. The chapters are easy to follow, and the tools made it simple to put the knowledge into action. I now feel more financially prepared for whatever comes next.”

– Matthew T., 48, Forth Worth, Texas

“I bought this eBook because I wanted a secure way to protect my retirement savings. The step-by-step guide — from how to buy gold safely — to setting up a monthly routine. The appendix tools are easy to use and great for keeping track of everything.”

– Scott M., 67, Seattle, Washington

“At 36, I realized it was time to get serious about planning my financial future — especially with inflation eating away at savings year after year. This eBook gave me the clarity and structure I needed to start investing in gold with confidence. The strategy in Chapter 2 made total sense, and the tools in the appendix helped me take action right away. It’s practical, well-explained, and exactly what I needed at this stage of life.”

— Melissa R., 36 Baltimore

$127 TODAY: $37

-

Full 6-Chapter Guide: Step-by-Step Gold Strategy Blueprint

- Create Your Monthly Investment Planning System

- Access 5 Automated Excel Investment Tools& Resources

$127 TODAY: $37

-71%

This Opportunity Ends:

30-Day 100% Money-Back Guarantee — No Questions Asked

🔒100% Secure 256-Bit Security Encryption

🛡️Guaranteed Safe Checkout

Frequently Asked Questions

How do I get the guide?

Instantly! This is a digital e-book in PDF format. After your secure payment, you’ll be directed to a download page immediately.

Is this for complete beginners?

Absolutely. It was written with the beginner in mind, taking you from zero to confident investor.

Is my payment secure?

Yes, our checkout is processed by Gumroad, a world-leading secure payment platform. Your information is 100% safe.

P.S. Don’t let this be another one of those moments you look back on with regret.

For just $37, you can have a concrete plan for financial security.

And with a 30-day money-back guarantee, you have absolutely nothing to lose. The choice is yours.

Click the button and let’s get you started today.

Disclaimer

This page and the accompanying eBook are provided for educational and informational purposes only and do not constitute financial, investment, legal, or tax advice. Nothing on this site should be interpreted as a recommendation to buy, sell, or hold any security or commodity. You are solely responsible for your own investment decisions.

No Warranties; No Liability

While we have made every effort to ensure the accuracy of the information contained herein, we make no warranties—express or implied—regarding its completeness, usefulness, or accuracy. We will not be held liable for any errors or omissions, or for any outcomes resulting from your use of this information.

Risk Acknowledgment

All investments involve risk, including the possible loss of principal. Past performance is not indicative of future results. Before making any investment, you should consult with a qualified financial advisor who can evaluate your individual needs, objectives, and risk tolerance.

Affiliate Disclosure

Some of the links on this page are affiliate links. This means we may earn a small commission—at no extra cost to you—if you choose to purchase through those links. We only recommend products and services we genuinely believe in.

Non-Affiliation Notice

This site is not affiliated with, endorsed by, or sponsored by Google, Meta, or any other third-party platforms. All trademarks and logos are the property of their respective owners.

Copyright

© 2025 CapGrow FInancial Education. All rights reserved.